The Next AI Gold Rush: Unpacking AI Startup Funding Trends for 2026

The artificial intelligence industry has completely transformed over the past few years, evolving from something mostly experimental into the backbone of where investors are putting their money. A couple of years ago, everyone was caught up in the race to build the best foundation models—think OpenAI’s GPT going head-to-head with Google’s Gemini. But that’s changing now. When you look at AI startup funding trends 2026 is shaping up to follow, it’s clear the money is moving toward startups that solve real problems with measurable returns, rather than those just building yet another large language model.

This comprehensive guide breaks down the future of AI investment, identifying the five key sectors set to capture the lion’s share of venture capital (VC) funding and providing a framework for strategic investment.

The Maturing Market: Why 2026 is Different

In the landscape shaped by AI Startup Funding Trends 2026, investors are no longer pouring cash into anything with an AI label. They want to see real traction—paying customers, focused expertise, and solid proof that the business actually works. Since building a foundation model from the ground up demands enormous costs and heavy infrastructure, venture capital has shifted course. Instead, they’re backing teams that use existing models to solve concrete problems within specific industries. It’s no longer about reinventing the wheel, but about finding the people who understand which problems truly matter.

Key Shifts in Investor Mindset

- From Foundational to Applied: Money is flowing away from building the next core LLM and towards specialized AI layers (S-LLMs) and application-specific tooling.

- The AI Moat: The new competitive advantage isn’t the model itself, but the proprietary data loop and integration depth into enterprise workflows.

- Focus on ROI: VCs demand clear, measurable return on investment (ROI) from AI solutions, moving past “cool factor” funding.

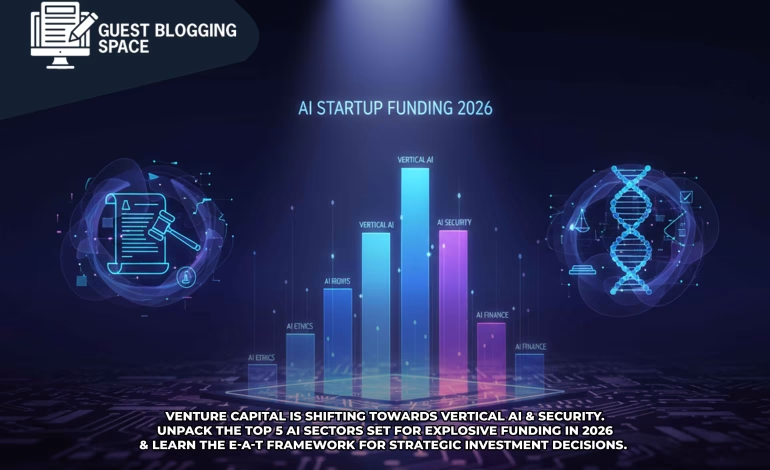

Top 5 AI Sectors Set for Explosive Funding in 2026

Based on current technological acceleration, market demand, and enterprise spending patterns, these five areas will see the most significant VC activity in 2026.

- Vertical AI Agents (The Specialist Layer)

These are AI solutions hyper-focused on one industry (e.g., legal, finance, healthcare) or a single, complex task (e.g., fraud detection, contract review).

- The Trend: Generic LLMs often make errors when dealing with sector-specific jargon and regulatory compliance. Vertical AI Agents are fine-tuned on proprietary, highly specific datasets, offering 99% accuracy where generic LLMs offer 80%.

- Why VCs Love It: They solve a high-pain, high-value problem in a specific industry, leading to strong product-market fit and high switching costs.

Examples of Funded Startups:

- LegalTech AI: Tools that review thousands of legal documents for compliance in minutes.

- MedTech Diagnostics: AI assisting radiologists in detecting anomalies in scans with higher precision than the human eye alone.

- AI-Native Security and Governance (The Trust Factor)

Now that AI is woven into the fabric of how businesses actually operate, the stakes have gotten much higher. Companies are dealing with real threats—sensitive data slipping through the cracks, models confidently spewing nonsense, and sophisticated attacks designed to break them. Because of this, we’re seeing a massive surge in funding flowing toward startups building security tools specifically for AI systems. Investors recognize that as AI adoption accelerates, protecting these systems isn’t optional anymore—it’s essential.

- The Trend: Enterprises need new governance layers to ensure their AI models are safe, compliant, and explainable (XAI). This includes MLOps (Machine Learning Operations) tools with built-in compliance checks.

- The “Kamiyan” (Gap) in Current Tech: Legacy cybersecurity tools cannot effectively monitor and secure the non-linear, unpredictable nature of LLMs.

Investment Focus:

- Data Provenance/Watermarking: Verifying the origin and integrity of data used to train and run AI.

- AI Firewall Solutions: Dedicated security layers to protect models from prompt injection and data poisoning.

- Edge AI and Hyper-Personalized Devices

The need for real-time processing and data privacy is pushing AI models off the cloud and onto devices (smartphones, IoT sensors, industrial machinery). This is “Edge AI.”

The Trend: Efficient, small-footprint models (S-LLMs) that can run on low-power hardware, enabling instant, personalized experiences without data leaving the device.

Key Drivers:

- Regulatory pressure (GDPR, CCPA) demanding data privacy.

- Industry 4.0 applications (predictive maintenance on factory floors).

What VCs are Looking for: Hardware-software co-design teams and specialized chip makers optimizing for AI workloads at the edge.

- Synthetic Data Generation (The Data Solution)

The quality of AI models is limited by the quality and quantity of available training data. Generating high-quality, synthetic (artificial) data is the solution for many startups, especially in highly regulated sectors.

The Trend: Startups are using generative AI to create synthetic datasets that mirror real-world data distributions but are free of personally identifiable information (PII) and biases.

Massive Benefit: It speeds up model training and enables rapid R&D in areas where real data is scarce, sensitive, or expensive to collect (e.g., rare diseases, military simulations).

Funding Thesis: Companies mastering synthetic data creation are essentially unlocking the next generation of other AI companies.

- AI for Biological Design and Drug Discovery

This area combines the computational power of AI with the complexity of biological systems, dramatically accelerating the timeline for developing new drugs and materials.

- The Trend: AI is being used to predict protein folding, optimize drug compounds, and design novel materials with specific properties (e.g., stronger, lighter alloys).

- Why the Sudden Interest: Traditional R&D in biotech takes 10+ years and billions of dollars. AI shortens this to months, offering a clear path to high-margin, life-changing products.

- Investment Focus: Companies specializing in Generative Biology and Structure Prediction Models.

The E-A-T Framework for Ranking in 2026

Google’s emphasis on E-A-T (Expertise, Authoritativeness, Trustworthiness) is now more critical than ever, especially for high-stakes topics like investment and technology. To rank successfully for “AI Startup Funding Trends 2026” on a blog competing with TechCrunch, you must incorporate the following:

- Expertise (E)

Data-Driven Arguments: All predictions must be backed by verifiable data (e.g., Q3 2025 VC reports, patent filings, or specific open-source development metrics).

Industry Deep-Dives: Do not stay at a surface level. When discussing Vertical AI, give specific examples of the regulatory challenges in that sector (e.g., FDA approval process for MedTech AI).

Authoritativeness (A)

- Citations and References: Cite credible sources (e.g., Crunchbase, PitchBook, Gartner reports). This is non-negotiable for investment topics.

- Thought Leadership: Introduce novel frameworks or terminology (like “The AI Moat” or “Specialized AI Layer”) to position the content as a leading analysis.

Trustworthiness (T)

- Transparency: Clearly separate factual data from expert opinion and future prediction.

- Review Process: (If published on a website) Ensure the article is explicitly attributed to an expert with relevant credentials (e.g., a former VC, a data scientist, or an industry analyst).

Actionable Strategies for Strategic Investment in AI

For investors, entrepreneurs, and observers, navigating the 2026 market requires calculated risk and focused due diligence.

Checklist for Evaluating an AI Startup:

- Is the “Moat” Data-Proprietary? Does the startup own a unique data set or access a feedback loop that its competitors cannot replicate?

- Is it a Feature or a Company? Could this AI product be easily replicated as a feature within a larger platform (e.g., Microsoft, Google)? If so, it’s a weak investment.

- What is the Cost-to-Serve? How much does it cost the company to run the AI model per user (the inference cost)? Low cost-to-serve equals higher profitability.

- Is it Compliance-Ready? For vertical AI, does the solution meet current and anticipated regulatory standards (HIPAA, ISO, etc.)?

Note: The most promising opportunities in AI Startup Funding Trends 2026 are likely to center on companies that pair exceptional technical talent with proven cost efficiency and a thoughtful commitment to governance and security from the very start.

The Threat of Commoditization

The core LLM layer is rapidly becoming a commodity. Just as cloud infrastructure (AWS/Azure) became a utility, the underlying models are moving towards becoming standardized tools. The value shift is dramatic:

- Value in 2024: Model building and inference speed.

- Value in 2026: Fine-tuning, prompt engineering, integration into workflow, and data specialization.

Within AI Startup Funding Trends 2026, founders need to shift their focus from merely showing off model performance to proving how their solutions integrate into real workflows and deliver measurable business results.

The AI Future is Specialization

What we’re seeing in 2026 isn’t another hype cycle built around one flashy innovation. Instead, it’s about AI finally embedding itself deep into specific industries and actually delivering results. Venture capitalists have learned their lesson—they’re chasing companies that can show real returns and have something competitors can’t easily replicate, usually proprietary data.

When you examine AI startup funding trends 2026 is following, the smart money is clustering around a few key areas: specialized AI agents built for particular industries, security solutions protecting AI systems, edge computing that processes data locally, synthetic data generation, and the emerging field of generative biology. Investors putting their chips on these sectors aren’t just betting on technology—they’re positioning themselves right where the next major wave of disruption is already beginning to crest.

Frequently Asked Questions

What is the difference between Foundational Models and Vertical AI Agents?

Foundational Models (e.g., GPT-4) are large, general-purpose models trained on massive, broad datasets. Vertical AI Agents are smaller, highly specialized models fine-tuned on a narrow, industry-specific dataset (like legal documents or medical images) to achieve near-perfect accuracy for a single, high-value task within that domain.

Will the large amount of capital invested lead to an AI bubble in 2026?

In the context of AI Startup Funding Trends 2026, valuations may be lofty, but most investors see a market that’s maturing rather than bubbling. Unlike the dot-com era, today’s AI companies often show real revenue, solid enterprise contracts, and clear returns on investment. The bigger risk isn’t the technology falling short—it’s that certain business models could falter under commoditization or the burden of high inference costs.

Why is “AI Security” becoming a major funding trend?

As AI Startup Funding Trends 2026 continue to evolve, one of the most urgent concerns is the growing vulnerability of AI models to threats like prompt injection and model poisoning. These attacks can distort a model’s output or behavior, creating serious financial and legal risks for any business relying on them. Because traditional security tools weren’t built to handle these challenges, an enormous new market is emerging for security and governance solutions designed specifically for AI.

What is the biggest challenge for AI startups seeking funding in 2026?

One of the toughest hurdles in AI Startup Funding Trends 2026 is proving that your company has a real, sustainable “AI moat.” If a rival can match most of your product’s performance with nothing more than a public LLM API, then the advantage isn’t defensible. That’s why investors are putting their weight behind startups whose core value comes from proprietary data or integration networks that competitors simply can’t replicate.

How does E-A-T impact the ranking of AI-related content?

Because AI Startup Funding Trends 2026 fall under Google’s YMYL guidelines, demonstrating strong E-A-T has become essential. Content needs to be created or vetted by someone with recognized expertise, supported by credible sources, and presented with clear, transparent fact-checking. That level of trust signals to both users and search engines that the information is reliable enough to guide important financial and technological decisions.

1 Comment

https://shorturl.fm/H9LZF